Posts on Happily Homegrown contain affiliate links. When you make a purchase through an affiliate link, your price will be the same, but Happily Homegrown will receive a small commission. Thank you for your support!

Thank you to Beyond Personal Finance for sponsoring this post, and providing a copy of Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum for me to review.

“Where are you going to college?”

“What’s your major?”

“What are you doing after high school?”

Not once did anyone have a conversation with me about how these things are related or how much they could/would impact my finances.

Luckily, I knew I wanted to be a teacher and that if I went to college, got my Bachelor’s degree, and passed the PRAXIS I would be able to get a job and teach in New Jersey. I did however have a detour when I transferred colleges and had to change majors.

I picked my new major by taking the course catalog, which was an actual book, and flipping the pages and putting my finger down at random. It landed on Public Relations. Not the best way to make a decision about what I was going to study in college but it’s what I did. I didn’t know what type of job that would lead to or where I’d end up. All I knew was switching my major would allow me to transfer colleges and at that time that was most important.

As the first person in my family to go to college, how we were going to pay for it was a BIG conversation. Luckily, I qualified for scholarships and received a few grants so I didn’t have to take many loans. At least not initially. We didn’t talk about private college vs state schools. The only part I looked at was who was going to give me the most money and resources, with as little out of pocket as possible.

Crash Course in Finances

No one in my family ever really discussed finances. I would grocery shop and coupon with my mom, but that was the extent of it.

As a young adult, learning to manage my finances was often frustrating. I felt like it was a right of passage and I should know what to do. I should be able to afford going out to eat, paying my car note, and traveling simply because other people my age were doing it.

Early in our marriage, Steve was hired by Princeton University. While we were both excited for this new chapter, the pay periods were stressful. The university only paid salaried employees once a month on the last banking day. Then, to make things even more challenging, in June (for the end of the fiscal year) and December (for the end of the calendar year) he would get paid on the 20th … and then not again until the last banking day of the following month! That meant 6 weeks without a paycheck!

When you are used to getting paid every other week, switching to once a month was incredibly stressful. That job forced us both to budget, discuss finances regularly, and take the stigma out of talking about money, at least with each other.

During this time we both got comfortable saying that certain events or activities weren’t in the budget. Friends and family understood that if they wanted us to go somewhere with them, we would need to budget for it because we may not have a paycheck for 3 more weeks.

I was thirty when I finally felt like we had it together and I understood our finances. And after being at that university for 23 years, that once-a-month paycheck isn’t quite as scary.

What do you want to be when you grow up?

I am now homeschooling two high schoolers, and they are getting questions about what they want to do with their life. That’s a hard question for a 15-year-old to answer. They may have some ideas, but where will those ideas take them? To college? Trade school? Directly into the workforce?

They know that their choices will have a lasting impact and it’s ok to not know what they want to do right now. But it is still important to play out different scenarios so they know what the possibilities are.

We often have conversations about finances as a family and why we chose the jobs we have currently. We talk about going to college, and how I graduated over 20 years ago and am still making loan payments (I did defer my loans for a few years there and the accrued interest burned me in the long run). Part of homemaking and homeschooling is having my children understand what the real world is like.

Financial Reality Check

Kids today don’t understand how much things cost. Recent spikes in inflation mean that a lot of adults don’t know what things cost either.

Having an understanding of what things cost and what the options are is increasingly important. These aren’t the conversations I had with my parents growing up. And my parents didn’t have these conversations with their parents. No one talked about money – income or expenses. We need to change that for our children so they don’t make the same mistakes or have the same challenges that we had.

Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum

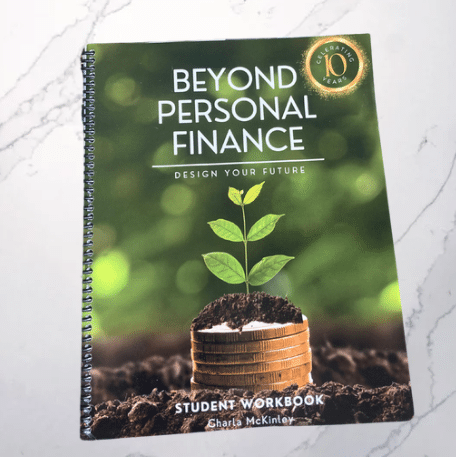

Recently, I got my hands on the 10th-anniversary edition of Beyond Personal Finance Teen, which is a self-paced online curriculum for those ages 13+.

This curriculum is unlike anything else I’ve seen. Instead of just lecturing students on the importance of saving and being debt-free, Beyond Personal Finance is a simulation that takes students from age 22-42.

Each decision that is made has a financial impact. Your student will begin to see that every decision they make from what job they take to where they go to school to what they eat for dinner can impact their financial success.

While this is only a simulation for the student to work through, decisions made during the course could have an impact on the decisions made in the student’s actual life.

Some decisions your student will face include:

- what type of job they want

- where they want to live

- whether to buy or lease a car

- to cook at home or go out to eat

If you think this sounds like Adulting 101, you’re not wrong!

Better to be faced with these choices and see their impact when you still have the safety net of it being a simulation than to be thrown out in the real world and learning on the fly.

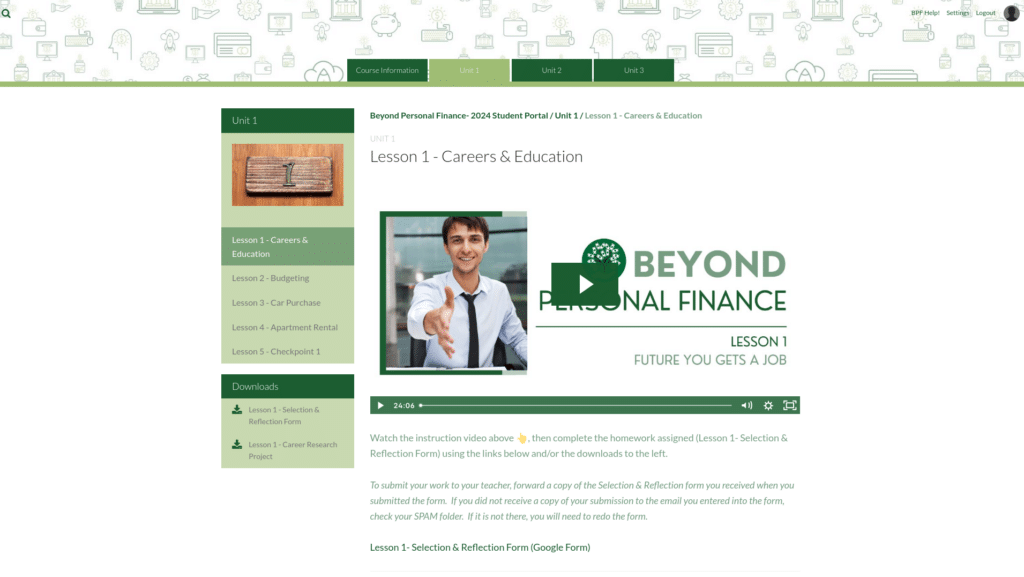

Lessons are presented in the student portal. Each video is paired with a section in the workbook. Students will watch the video, pausing as needed to complete the activity, and then return to the video. Depending on the topic, some lessons will take longer than others but everything is explained in the video to make it easy for the student. Parents do not need to be a subject expert to implement Beyond Personal Finance with their children.

Getting Started

Now that you have decided to use Beyond Personal Finance Teen (13+) Self-Paced, Online Curriculum a high school elective, or a math elective specifically, if you track things that way, it’s time to order your curriculum.

What you’ll receive as part of your $150 curriculum package:

- 365-day online membership to Student & Teacher Portals (start when you are ready, and extend for 30 days if needed)

- Portal access to self-paced video teaching.

- Full-Color Student Workbook designed to enhance the video teaching.

- Electronic and Hard Copy Lesson Assignments and Tests via Student Portal.

- Online Teacher Resources including a brief coaching video for each lesson as well as lesson plans and ideas for extension.

This 20-lesson course doesn’t drag on like other curriculums do, but if you need more than 365-days to complete the program, just send them an email and they’ll be happy to extend things for you.

Best Value Headset for Students

Best Value Headset for Students

Leave a Reply